“AV is a 10 out of 10. I’ve been an investor since 2019 and have enjoyed witnessing AV’s growth and success over the past 5+ years. I have been impressed with the personal service, attention to detail, accessibility and professionalism of AV’s leadership and every team member. The breadth and depth of offerings across industries and Stages, AV’s embrace of AI, and their ability to co-invest with the strongest names in VC have been impressive as well. I can’t imagine a better way to have been introduced to the VC space as an individual investor, and I proudly wear my AV swag, read every AV LinkedIn post, excitedly open emails from AV leadership, and eagerly anticipate yellow envelopes in the mailbox. I am proud to be an investor and owner, and share my enthusiasm about the trajectory of AV with family, friends and colleagues. For anyone interested in expanding their investments into VC and private companies, I would highly recommend AV.” – Matt H. AV Investor since 2019

Meet Matt H.:

AV Investor with an Extraordinary Journey in VC

“AV is a 10 out of 10. I’ve been an investor since 2019 and have enjoyed witnessing AV’s growth and success over the past 5+ years. I have been impressed with the personal service, attention to detail, accessibility and professionalism of AV’s leadership and every team member. The breadth and depth of offerings across industries and Stages, AV’s embrace of AI, and their ability to co-invest with the strongest names in VC have been impressive as well. I am proud to be an investor and owner, and share my enthusiasm about the trajectory of AV with family, friends and colleagues. For anyone interested in expanding their investments into VC and private companies, I would highly recommend AV.” – Matt H. AV Investor since 2019

Meet Matt H.:

AV Investor with an Extraordinary Journey in VC

Alumni Ventures

Your Venture Capital Partner

See video policy below.

#1

most active venture firm in the US (Pitchbook 2022)

1,100+

portfolio companies

$1B+

total capital raised

9,000+

investors

A Venture Fund for Every Objective

Alumni Funds

Invest with and in fellow alumni and friends of the community

- Home

Portfolios of ~20-30 investments diversified across sector, stage, geography, and lead investor

- Home

Invest, network, and learn with classmates

- Home

Includes membership in fund Venture Club and access to Syndications

- Home

Includes Community Funds which have a minimum investment of $10K

Total Access Fund

Exposure to every new AV deal

- Home

Portfolio of ~50-75 investments per quarter; diversified by stage, sector, geography, and lead investor

- Home

Invest in up to four quarters at a time

- Home

Every investment sourced and sponsored by our 20+ full-time venture investing teams

- Home

Includes membership in fund Venture Club and access to Syndications

Focused Funds

Thematic investment strategies

- Home

Portfolio of ~20-30 diversified investments

- Home

Available Focused Funds include:

- AI Fund

- Sports Fund

- Deep Tech Fund

- Doctors Innovate Fund

- Seed Fund

- Women’s Fund

Opening Soon:

- US Strategic Tech Fund

- Cancer Fund

- Home

Includes membership in fund Venture Club and access to Syndications

What We Can Do for You

Alumni Ventures creates and offers diversified and personalized venture portfolios. We invest alongside other established venture capital firms. You decide your funds, investment amount, and level of engagement.

Decide the right allocation for you.

- HomeWe believe a venture portfolio should be considered in every sophisticated portfolio.

- HomeDiversifying your portfolio can reduce risk and increase rewards.

- HomeDetermine your personal asset allocation strategy.

Conservative

Aggressive

Investor & Entrepreneur Testimonials

Real quotes from real community members.

See testimonial policy below.

Investment Strategy

We believe in diversification, investing alongside established lead investors, and running a disciplined and rigorous process.

- Home1

Our network helps us source, vet, and access great venture deals.

- Home2

Our 20+ distinct investment teams work to win allocation into the most competitive venture deals.

- Home3

Our rigorous and disciplined processes provide our investors with smart, simple venture capital portfolios.

Get to Know Us

- Home

Human

Yes, we are a bit nerdy and love thinking about the future. But we are also relatable “I’d have a beer with them” people who are happy to answer questions or just chat. - Home

Experienced

Our team has hundreds of years combined in accessing promising venture deals. - Home

Transparent

We’ll be open and honest with you. At the bottom of this page are 7 very good questions we are asked a lot.

Personalize Your Experience

Invest and Observe

I want to invest and get back to life.

Customize and Engage

I want to personalize my venture portfolio and experience.

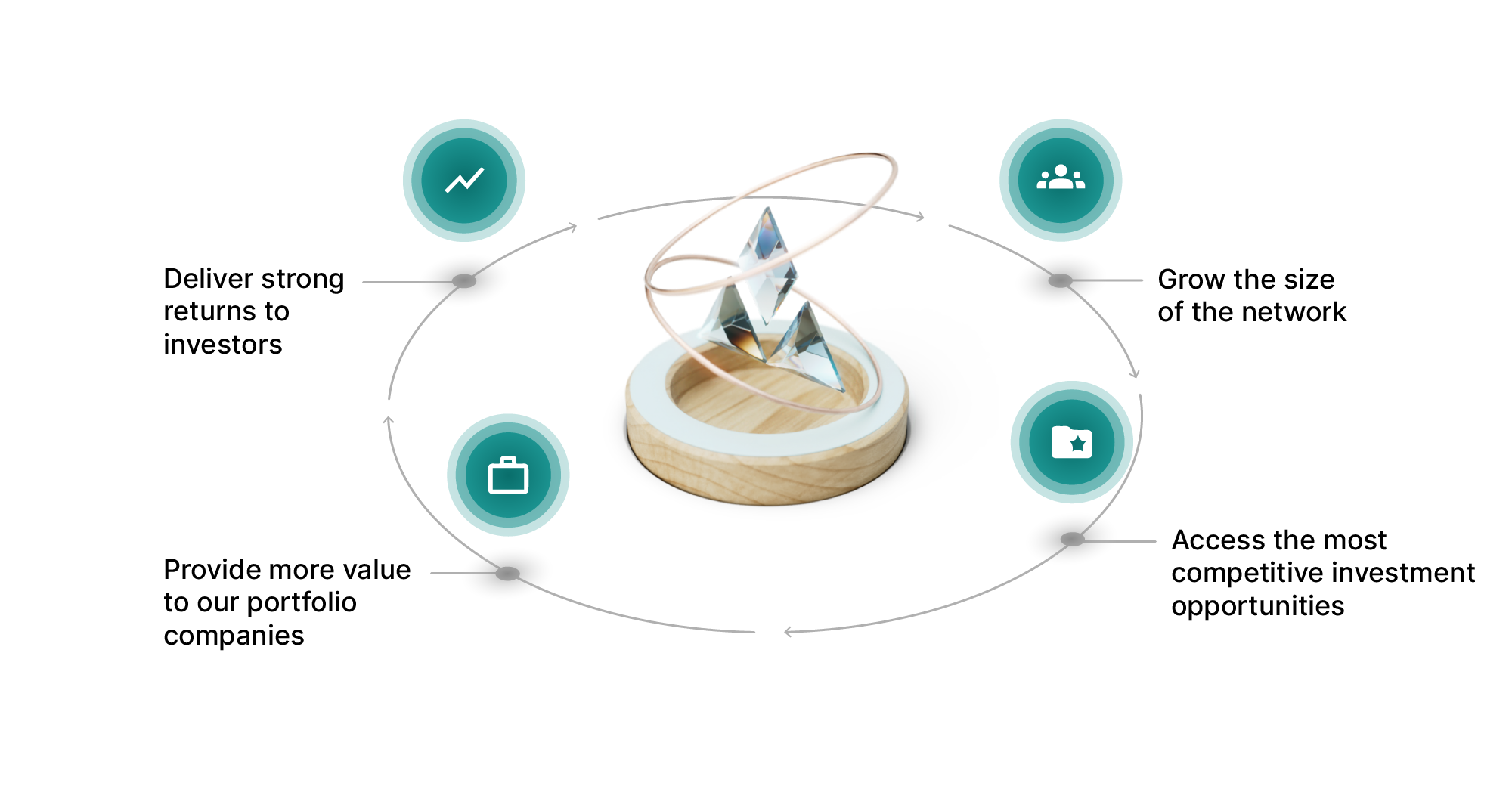

Our Secret Sauce

Alumni Ventures is a network-powered VC firm. Our community is our source of capital, expertise, and how we add value to our portfolio companies.

Frequently Asked Questions

FAQ

There are many reasons to consider venture capital. Here are five that make a strong argument.

Returns: Venture capital is an asset class that has outperformed the S&P over many periods.(1)

Portfolio diversification: Since VC returns aren’t completely correlated to the stock market, a venture portfolio is a way to diversify your overall portfolio.(2) AV offers venture portfolios diversified by sector, stage, region, and lead investors.

Staying private longer: Many ventures are staying private longer. When they do go public, they already have significant value creation behind them. (3)

Impact: Many of the companies our funds invest in are tackling society’s toughest challenges in health, energy, finance, transportation, and more. Investing in VC is fundamentally an optimistic statement that the future can be better.

Learning: Most of our investors are naturally curious people, looking to learn and understand what is new and what is next.

(1) Cambridge Associates, Venture Capital Benchmarks, March 31, 2019, (2) The Inverse Correlation Between Venture and Public Markets, March 2016, (3) Forbes, “Why more businesses are choosing to stay private,” February 26, 2020.

Broad and diversified venture portfolios with community: Most venture investors to date have been institutions who could commit millions per venture firm and have the resources to invest in multiple venture firms. In contrast, AV provides accredited investors a large, diversified venture portfolio for just $25K – $50k per fund.

Deal access and flow: We offer investors access to a portfolio of highly competitive deals invested alongside other established venture firms. Our investment activity consistently puts us among the most active VCs in the world according to PitchBook.(4)

Risk management through large, diversified portfolios: Our Alumni and Total Access Funds provide diversification across stage, sector, geography, and lead investor. In addition, given venture’s power law characteristics (a few huge winners offset losers), larger venture portfolios can reduce risk of loss while having an attractive upside compared to smaller venture portfolios.(5) Compare this to individuals who do an occasional one-off deal. For them, the likelihood of a substantial or complete loss of capital increases significantly.

Co-investing strategy: We invest alongside VCs with sector and/or stage expertise who lead the round and negotiate terms. Accessing promising venture deals is what our 20+ full-time investment teams are committed to delivering for you.

Community: AV leverages a network of 550,000+ subscribers and community members to source capital and deals, conduct due diligence, and assist portfolio companies. Our community grows daily, and our new Venture Clubs take our commitment to investor engagement, education, and network sourcing even further.

(4) PitchBook 2020 Annual Global League Tables, February 18, 2021. (5) Steven Crossan, “Modelling Suggests Rational Venture Investors Should Have Bigger Portfolios,” April 11, 2018.

We have 50+ investment professionals across AV’s family of funds and our Office of Investing. Our OOI helps source, evaluate, and coordinate deals. Most of our actively managed funds also have their own Investment Committee, consisting of experienced investors and business executives.

Our Alumni Funds are managed by a team of 2-4 full-time investment professionals per fund with strong investing and entrepreneurial experience. Our investment decision making is process-based, and the ultimate decision is based on the analysis and rating of a collective vote of the sponsor fund, sponsor fund’s Investment Committee, and the AV Investment Committee.

Our Total Access Fund and Focused Funds are managed by AV’s Office of Investing, with portfolios created from deals sourced and invested in by our Alumni Funds, as well as our dedicated Focused Fund investment team.

Our funds are only open to accredited investors. The SEC defines an accredited investor as someone who (a) has earned income that exceeded $200,000 (or $300,000 together with a spouse) in each of the prior two years, and reasonably expects the same for the current year, OR (b) has a net worth over $1 million, either alone or together with a spouse (excluding the value of the person’s primary residence), OR (c) holds certain professional designations in good standing approved by the SEC. Further details are available here.

Our Alumni Funds have a minimum of $25,000.

Our Total Access Fund has a minimum of $25,000.

Our Focused Funds minimums start at $25,000.

Syndication opportunities, available only to existing investors, typically have a minimum of $10,000 – $25,000.