Waterman Ventures' Principal is Ever True to the Next Wave of Innovation

Principal Dave Fan is ready to facilitate the growth of entrepreneurship within the Brunonian community.

Dave Fan didn’t set out to find a career in venture capital. However, after a college seminar introduced him to the world of entrepreneurship, he hasn’t looked back.

Dave is now the Principal of Waterman Ventures, one of Alumni Venture Group’s (AVG) family of private, for-profit funds that enables Brown alums to invest in ventures connected to fellow alums. He recently sat down with us to talk about how Brown has shaped his career so far and trace his journey to Waterman.

How did you make your way to Waterman?

I originally enrolled in a combined undergrad and medical school program at Brown, but an entrepreneurship seminar sparked a passion for startups and business. After interning during the financial crisis, I started my career in investment banking and corporate strategy at Deutsche Bank, then moved into sales/BD roles at Zocdoc and Shibumi. In my free time, I invested in startups through NextGen and CRE, which I found to be so stimulating and fun that it led me to pursue VC full time.

What sparked your interest in working at Waterman?

Timing and luck. By coincidence, I sat down next to Waterman Managing Partner Ludwig Schulze at the entrepreneurship table during a Brown alumni networking event. After getting to know him, the AVG team, and our unique model, it was a no-brainer!

How did your time at Brown and the connections you made there influence your career?

Brown is a magical place, so the community is naturally tight-knit. Many of my closest friends and mentors are Brown alumni. Brown’s ethos is to keep an open mind, be useful, and chart your own course with a humble and jovial attitude, which is the common thread across many alums’ unconventional career paths and entrepreneurial mindsets. Waterman Ventures has brought my journey full circle in many ways: I look forward to collaborating with a favorite professor and fraternity brother on the Investment Committee, several dorm mates who are now founders, and all other Brunonians who want to get involved.

What trends in venture capital are you excited about?

I am most excited about digital health, the future of work, and growing ecosystems beyond the big coastal cities. We live in the wealthiest, most technologically advanced society in world history, yet many of us grapple with physical, mental, and financial stress. I believe the next wave of innovation should focus on improving health, relationships, education, and how we work together in and out of the office.

What resources do you recommend to people interested in venture capital or entrepreneurship?

There is no substitute for hustling out in the field: attend events, build a network in your area of focus, and most importantly find ways to be helpful and give back. I am continually amazed by how connected and small the VC/entrepreneurship world has become over time. My three favorite books on entrepreneurship are Smart People Should Build Things by Andrew Yang, Zero to One by Peter Thiel, and How to Fail at Almost Everything and Still Win Big by Scott Adams. In terms of newsletters and podcasts, I recommend Fortune’s Term Sheet and Founders and Funders, respectively.

Is there a particular Waterman investment you’re excited about?

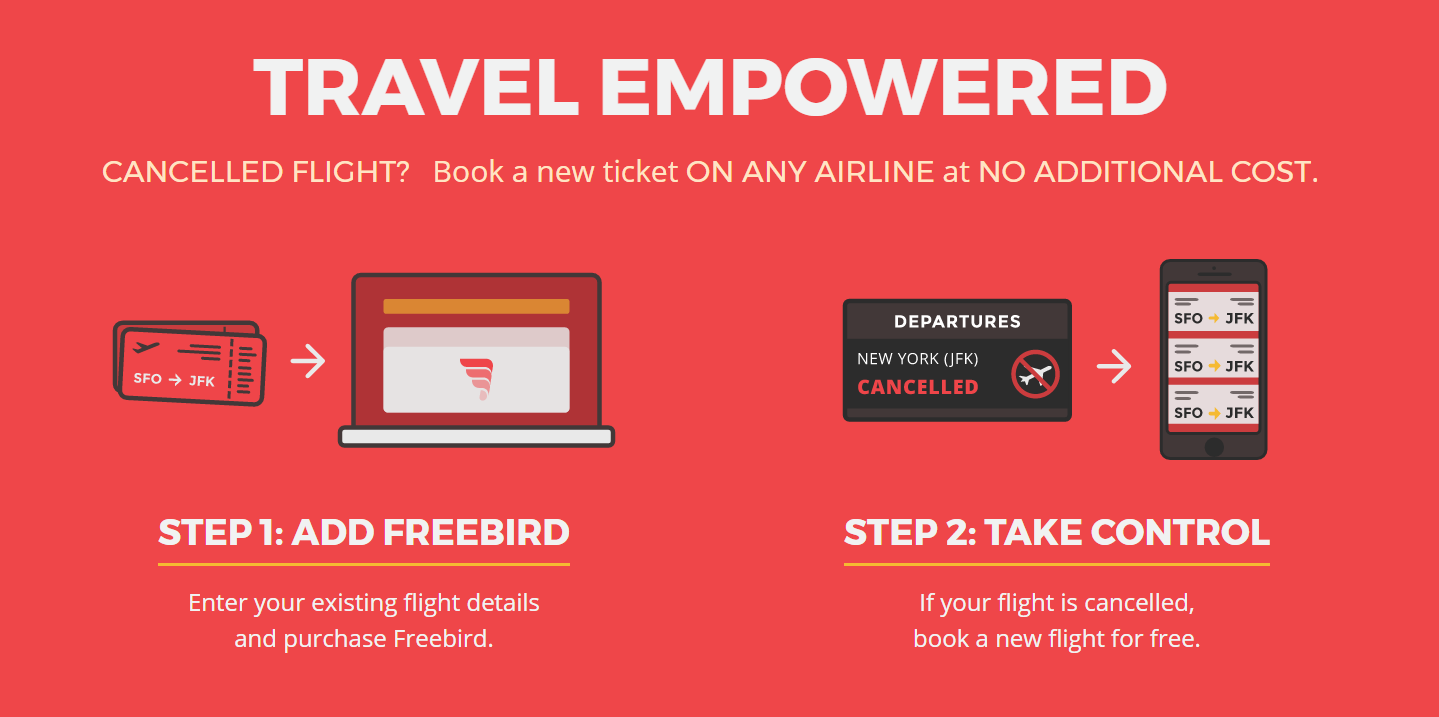

Funny you should ask! I recently had an amazing experience with one of our portfolio companies, Freebird. Founded by Brown alum and Expedia veteran Ethan Bernstein, they empower travelers to instantly book a new ticket — on any airline at no additional cost — in the event of a flight cancellation, significant delay, or missed connection. Two drastically different flights home from AVG’s HQ in Manchester, NH, showed me how Freebird delivers an incredible customer experience along with its value proposition.

After completing a smooth onboarding on my first day at AVG, my flight home was delayed 5 hours. I watched helplessly as United texted me throughout the day pushing the departure time further and further back. Since there were no other flights available on the same airline that night, I was at the mercy of United and Newark air traffic control. I didn’t get home until midnight and was exhausted the next day.

When I returned to Manchester the following week, I made sure to protect my trip with Freebird. An early winter storm dumped 6 inches of snow on New York and Manchester, snarling travel around the northeast. Luckily, the Freebird team reached out to me even before United texted about another 4-hour delay, informing me with a smiley emoji that they were standing by to help rebook. In three taps — less than a minute — they put me on a flight out of Boston, getting me home in good spirits and in time for the gym and dinner.

Long story short, this company is solving a massive headache for road warriors — and it’s great that Waterman and AVG are helping them do it.

Waterman Ventures is private, for-profit, and friendly but not affiliated with or sanctioned by Brown University. To learn more, join the Waterman community.