The Math and Method of Venture Capital: Engineering Success

Alain Hanover, Senior Partner at the AVG Elite Engineers Fund, unpacks common principles in venture capital and details core components to consider when constructing a portfolio.

In business as in life, it pays to be well-rounded. It’s one of the enduring truths of my education and career, and one of the core principles that inform my work with Alumni Ventures Group.

Venture capital (like all investments) follows some predictable patterns. We invest in a well-diversified group of companies in an effort to create portfolios that offer a satisfactory return. To the outside observer, this may appear to be a fairly simple transaction – put in capital, cross your fingers for a few years, pull out returns. But as with anything, it’s not just what you build that matters, it’s how you build it – and who’s drawing up the plans.

Alain Hanover

Senior PartnerAlain has 30+ years of experience as a VC, angel investor, CEO, serial entrepreneur, Board Member, and advisor. He was Co-founder of Common Angels, New England’s leading investment group; Managing Director and CEO of Navigator Technology Ventures, a high-tech VC firm funded by Draper Lab; and CEO of Viewlogic, an innovative chip design software company. Alain has mentored over 100 MIT high-tech spinoffs and served on the MassTech Board through the terms of six governors. He was honored as Inc Magazine’s Entrepreneur of the Year. He has BSEE and SB Math degrees from MIT, SM Computer Science from Harvard, and OPM from Harvard Business School.

The Math of VC

Before we get into the art of fund-building, let’s take a moment to go over the math. As with any investment model, there are a few general principles at play in any venture capital fund:

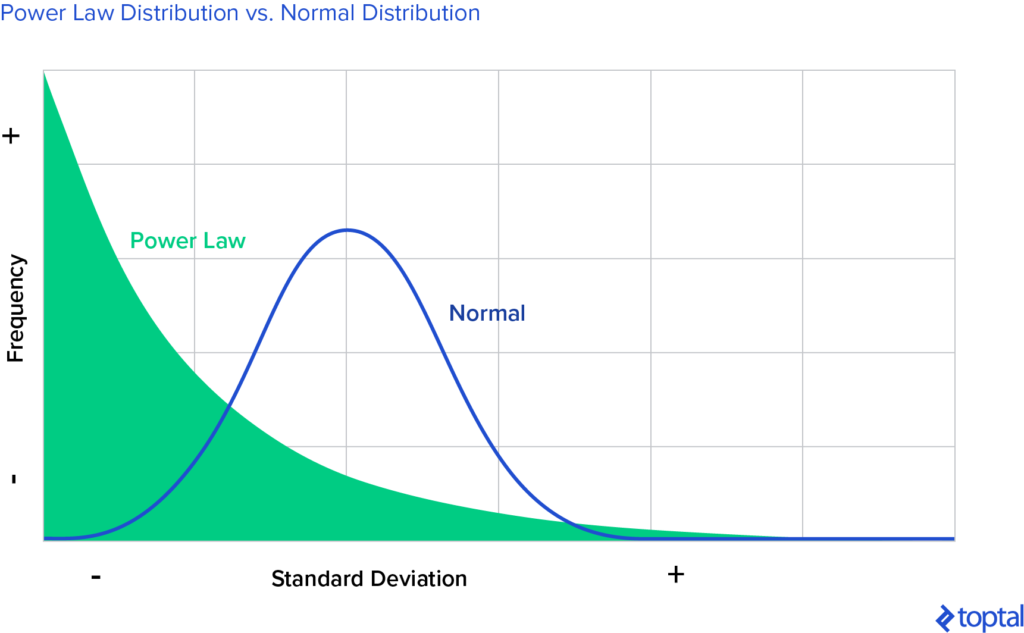

The Power Law

A Power Law, also called the Pareto Principle or the “80-20 rule,” is a recurring rule whereby a large percentage of returns will come from a relatively small portion of efforts. In terms of venture capital, this translates to several breakout companies that do exceptionally well at exit, and pay the largest portion of the fund’s returns.

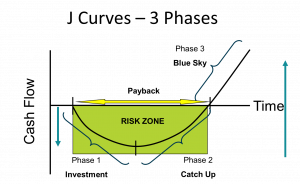

The J Curve

The J-Curve principle states that, historically, in the first years of an investment the company will have negative returns. As time goes on and those investments come to fruition (as the company grows sales, attains profits and eventually exits), investors realize returns. Most venture capital funds are structured to deliver returns over a 10-year period; while the overall returns for this asset class tend to be higher, the transition into positive EBITDA takes time.

Modern Portfolio Theory

A final model worth learning about in venture capital investment is the Modern Portfolio Theory (MPT). This approach to investment places less emphasis on picking the virtually non-existent “perfect stock” (or for our purposes, the perfect portfolio company) and instead focuses on creating a diverse, index-like portfolio of investments in order to reduce the overall risk. Thoughtfully constructed venture capital funds do exactly this.

With these principles in mind, our goal at AVG in building a successful fund isn’t to create a collection of moderate “winners,” but to invest in a healthy assortment of portfolio companies with the understanding that one or two of those will need to have sizable exits to repay the fund.

You may ask: if these principles virtually guarantee a specific distribution, do your portfolio companies even matter? Does your fund manager?

Simply put, yes. The investment team you choose, and the portfolio of companies they construct, has a profound effect on the ultimate performance of the fund.

Constructing a Portfolio: A Look Under the Hood

I’ve had the privilege to contribute to the development and success of many companies in my career, and held many roles within them: engineer, entrepreneur, investor, mentor. I’ve also shared my knowledge and experience as a lecturer and advisor for MIT and Bentley College. Through these roles, I’ve developed a multi-disciplinary understanding that underlies my role at AVG. Understanding the worlds of engineering and entrepreneurship ( on both sides of the table) has allowed me to take a comprehensive view of prospective investments.

Most (if not all) portfolio companies must have a core of components (management, product, marketing, strategy, execution, financial) that – given an accelerating boost of capital – are highly likely to produce results:

Technology

A company is first known for the products it creates, the markets it serves, and the problems it solves. Technology is one of the most recognizable components in the “secret sauce” that gives a company superiority. But it is certainly not the only ingredient, or even necessarily the most important one. Technology is the “good bones” around which a profitable, successful company is built.

Marketing

The best tech in the world can’t help anyone if the company can’t reach its target customers. This is where a thoughtful, comprehensive marketing plan makes the difference, building the audience and client base necessary to attract attention and returns. We look for companies that invest healthfully in promoting their products and services to large markets, and that have major competitive advantages.

Financials

The financial plan of a company is one of its most telling indicators in terms of longevity and investment viability. Good VCs don’t just get excited about novel tech and flashy marketing – they need to be equally enthusiastic about the company’s growth and financial prospects.

Management Team

From the engineering team and sales teams, to C-level executives and board members, the success of the company rests largely upon the insights and competencies of its management team. Getting to know the main decision-makers and innovators in a company, and their vision, can render deep insight into the future potential of a portfolio company.

The ability to recognize these qualities in a company, and to make the right calls in terms of investment and potential, depend heavily upon the education and experience of your fund manager, investment team, and their backgrounds.

The Well-Diversified Team

The benefits of a well-rounded investment team become readily apparent when it’s time to invest. Mirroring my own experiences, the investment teams working across our Core and Focused Funds bring the same benefits of intersectional knowledge and keen investment insight to their deal selection and advisement. Our Managing Partners (MPs) and Senior Partners (SPs) come from a wide range of industries, and bring a well-rounded understanding of the many facets of technology and investment. We collectively bring to the table deep insights and interdisciplinary knowledge. We also benefit from the vetting and insight of the top-tier VCs that act as the lead investors for our deals.

Our investors benefit from this broad and deep knowledge base in many ways, chief among them the confidence to invest with a deeper understanding of the process, understanding of companies in our portfolios, and through the improved potential outcomes of funds.