Infographic: How Fees Work in a Typical Alumni Ventures Fund

The Alumni Ventures family of funds encompasses core funds and focused funds, all tailored towards the retail investor.

Core funds, or alumni funds, follow a Fund Carry fees model, while focused funds follow a deal carry model. The infographics below lay out how our fees are structured in each case and what to expect if you choose to invest with us. For more details, you can review our Fees and Profit-Sharing policy document.

Three Things to Know about AV Fees

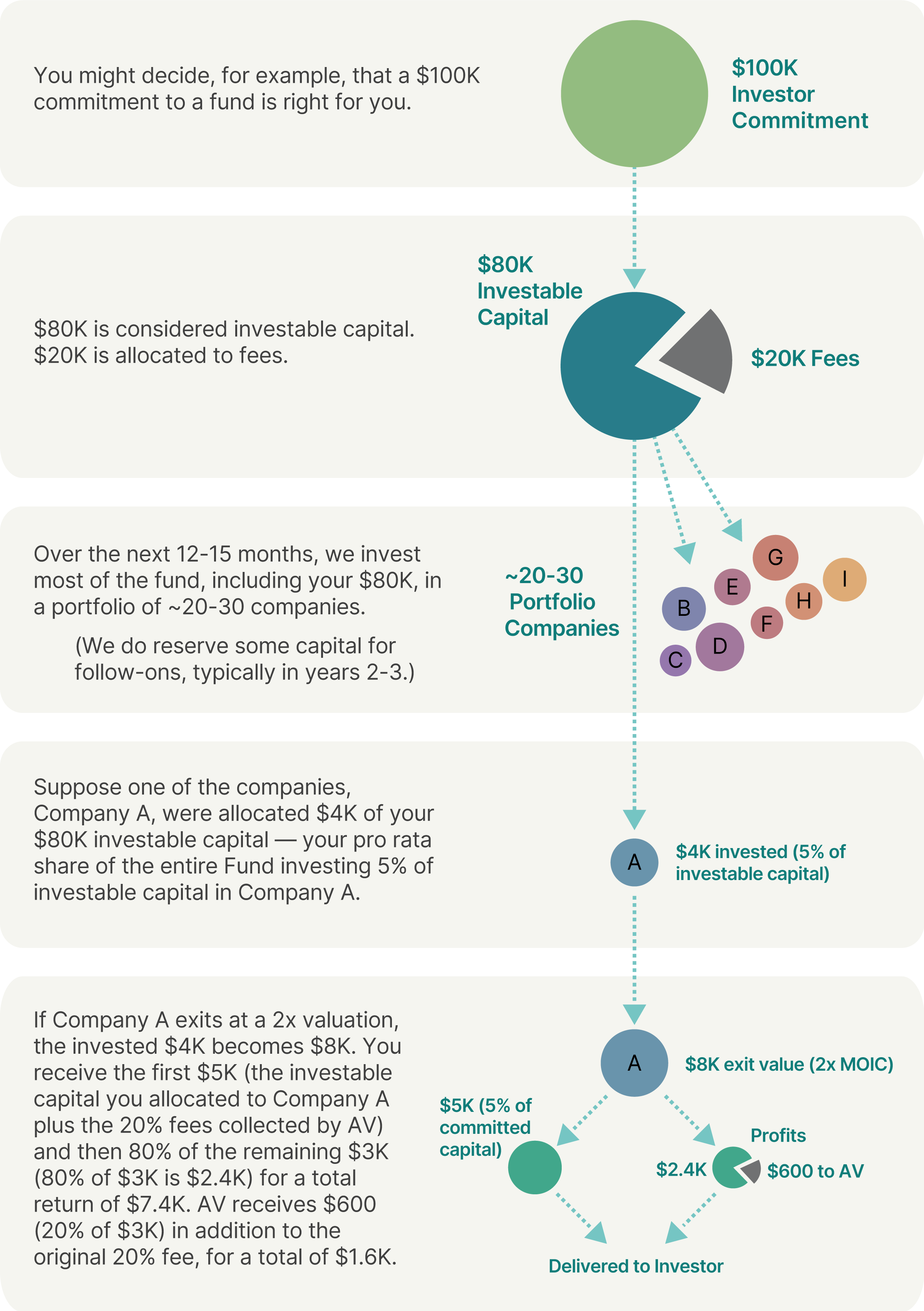

- HomeAlumni Ventures charges the equivalent of a 2% management fee for the fund’s 10-year term — 20% of the capital commitment — upfront.

- HomeFor Fund Carry, After all of the initial capital (including fees) is returned to investors, profits are split 80% to investors and 20% to AV. For Deal Carry, with respect to each individual portfolio company investment made by the fund, after all of the initial capital (including fees allocable to that investment) is returned to investors, profits are split 80% to investors and 20% to AV. This calculation is repeated for each investment made by the fund.

- HomeInvestors contribute their capital to the fund only once, within the fundraise window. There are no additional fees, even if funds are extended beyond 10 years.

Fund Carry

Fee Structure for Typical Alumni and Total Access Funds

Deal Carry

Fee Structure for Typical Focused Funds

Frequently Asked Questions

FAQ

No, we do not charge any other “soft” costs to cover legal, travel, or other admin-related expenses.

Yes, we reward investors with fee breaks as they commit more to AV. We currently offer lower fees to investors who commit more than $500K in capital. (Fee policies are not retroactive and are subject to change.)

We collect capital just once at the beginning of each investment because it’s efficient, transparent, and convenient for our investors. It lets us focus on what you pay us for: accessing promising venture deals. We also deploy capital quickly, investing most of it within 12-15 months. AV collects its management fee when you invest and reserves a designated portion to cover future potential needs of the funds.

Contact [email protected] for additional information. To see additional risk factors and investment considerations, visit avg-funds.com/Disclosures.