Capital Rx: A Cure for Overpriced Prescriptions

First online, cloud-native pharmacy benefits management platform

Pharmacy Benefits Managers (PBMs) manage prescription drug benefits for health insurers, Medicare Part D drug plans, large employers, and other payers.

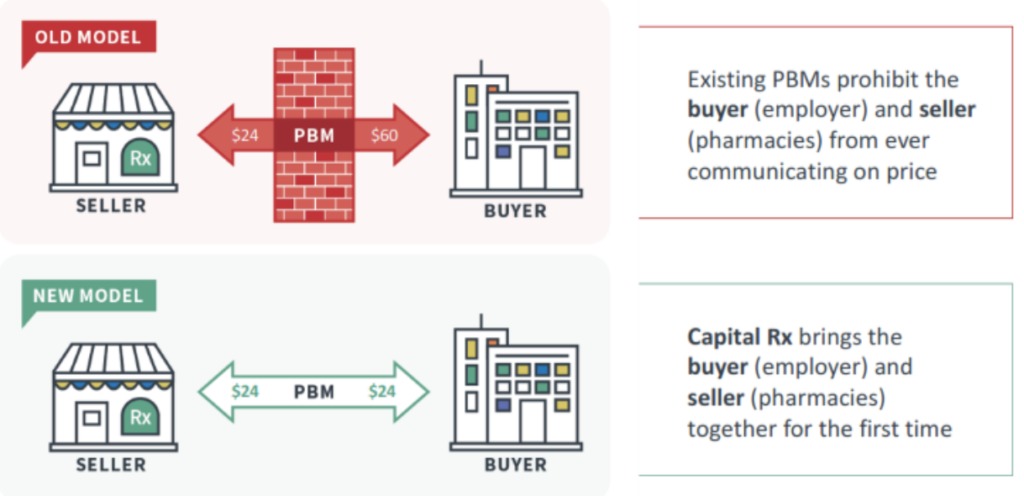

Traditionally, PBMs showcased an attractive healthcare model where employers and insurers hired these intermediaries to lower pharmaceutical costs. However, over time, many PBM leaders have adopted “spread pricing” (the difference between what PBMs charge buyers and how much they pay pharmacies), leading to an unnecessary increase in drug costs.

Alumni Ventures portfolio company Capital Rx is the pharmaceutical industry’s first online, cloud-native PBM to connect buyers (employers and health plans) with drugmakers. The company’s online platform provides price transparency and operational efficiency through services like formulary management, prescription claims processing, and clinical utilization programs.

An Improved PBM Model

Unlike legacy PBM systems that require specialized personnel, 400-600 hours of set-up, and 30-45 days for order changes, Capital Rx’s enterprise system reduces time spent to just a few hours. It uses a natural language platform that is user-friendly and reduces client costs.

Capital Rx has gained traction as an emerging industry leader with paying customers. Their customer adoption has also skyrocketed within the last year due to a strategic partnership with Walmart.

Deal Highlights and Leveraging Relationships

Proven value proposition: in just two years, Capital Rx has garnered a 96 NPS score (vs industry average of 24) and provided clients savings over 6x higher than the industry average.

Sizeable Addressable Market: The U.S. PBM Market is expected to reach $700 billion by 2025, offering Capital Rx a massive market opportunity.

Domain Expertise and Complementary Team: CEO Anthony Loiacono, COO Joseph Alexander, and CTO Ryan Kelly all worked at tech solutions company Truveris before Capital Rx. Eventually, Anthony — leveraging more than 20 years of experience in the pharmaceutical industry on manufacturing and payer sides — left Truveris to build Capital Rx, his ideal version of a PBM, bringing with him ~25 employees from Truveris.

Alumni Ventures’ Castor Ventures Fund (for MIT alumni and friends of the community) and sibling funds deployed capital in Capital Rxs’ $50 million Series B led by Transformation Capital. Castor Ventures Partner Cainon Coates learned about the deal through co-investor Edison Partners and leveraged a relationship with Transformation Capital to secure an allocation in the round.